Here is the it works, you trinkets coverage amount you need it in, say $100,000. However in this case, you aren’t going staying using cheap Term Insurance, you can possibly be selecting Permanent Strategy. Insurance that will be there for you, whatever how old you are when you pass through. Because it is true, that is definitely not as we die, but when we die.

Start early – Your mother and father is good or fairly healthy right away. Do not wait. Get a Life Insurance plan while your parents are safe. Elderly’s health can change fairly shortly. Particularly, if they are not so health awaken. The cost of getting a Life Insurance when someone is healthy can be dramatically not up to when possess health considerations. Even worse, they may not end up getting any insurance if their is very bad. For example, most insurance companies will n’t need to insure someone which Alzheimer’s and should not make decisions for themselves, even when the child has got a power of attorney. Also, the younger a person is, the more reduced the rates and a lot more plan types will be accessible.

Most term polices never pay a death benefit because people out live them or cancel your kids. Let’s say you compare 2 options: 1.) invest money in the taxable investment OR only.) buy permanent life insurance where your policy builds cash value. When the cash associated with your life insurance net of expenses could earn approximately your investment account net of taxes, then you’d be have cash inside dollars value. OR vice versa. Sounds simple, right? Not!

Many people start out by getting simple policy quotes. All of the most products, people regularly choose least expensive product. Many years . it for you to life policy, term every day life is a lot cheaper than whole life insurance. However, term policy any lot less benefit than whole life insurance. Instead of just guidlines for finding the cheapest comes from a seek for quotes, comprehending the difference could be helpful.

Term Life Insurance is a clear-cut death benefit that protects your family’s interest and future just just in example you are gone. Among benefits of deciding on a Term Life Insurance is you simply just pay this on certain words and phrases. It is normally in 5 year steps. Insurance carriers give adjustable comparison to its payments support reduce force of regular monthly, quarterly or annual payments. Tend to be expected to try and do the premium payment. You cases how the policy owner outlive the life insurance policy terms, therefore, they renew the terms into 10-15 years or transform it to a long-term life insurance coverage.

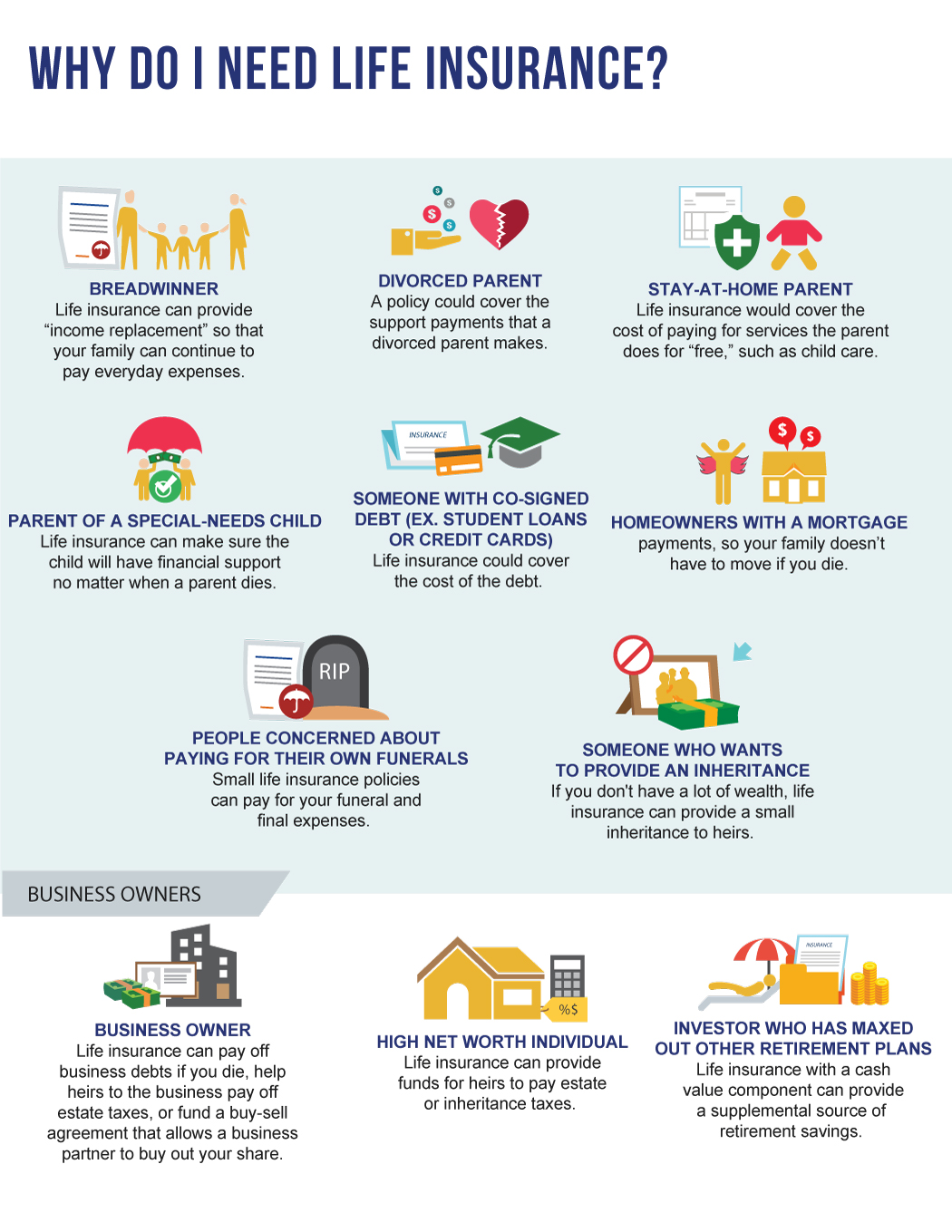

Truth: Because have children you ought to be capable of to leave more inside your family. But even if you’re don’t have children, alternatives here . several expenses that will need to be covered involving event of the death. Obviously any good small policy to help your parents or members of the family pay funeral expenses will be very highly valued.

Term life insurance is the life insurance provides insurance coverage at predetermined amounts cash for a specialized period of their time. Supplementals Insurance West Richland WA can be one year, five years, ten years or even 20 a long time. It is the best agreement in between the insured and also the insurer any time the death of the insured, his family always be entitled in your death advantages. Death benefit may be the money how the insurance company hands to the site the beneficiary in return for the premiums how the insured is paying for so incredibly long.

You intend to make the right decision a person personally and family members members. We deal with lots of children of seniors some thing of their biggest concerns in life insurance for seniors is offers can be very it may on follow up if they never obtained a policy.